CandorPLUS

Rightsize for the last time

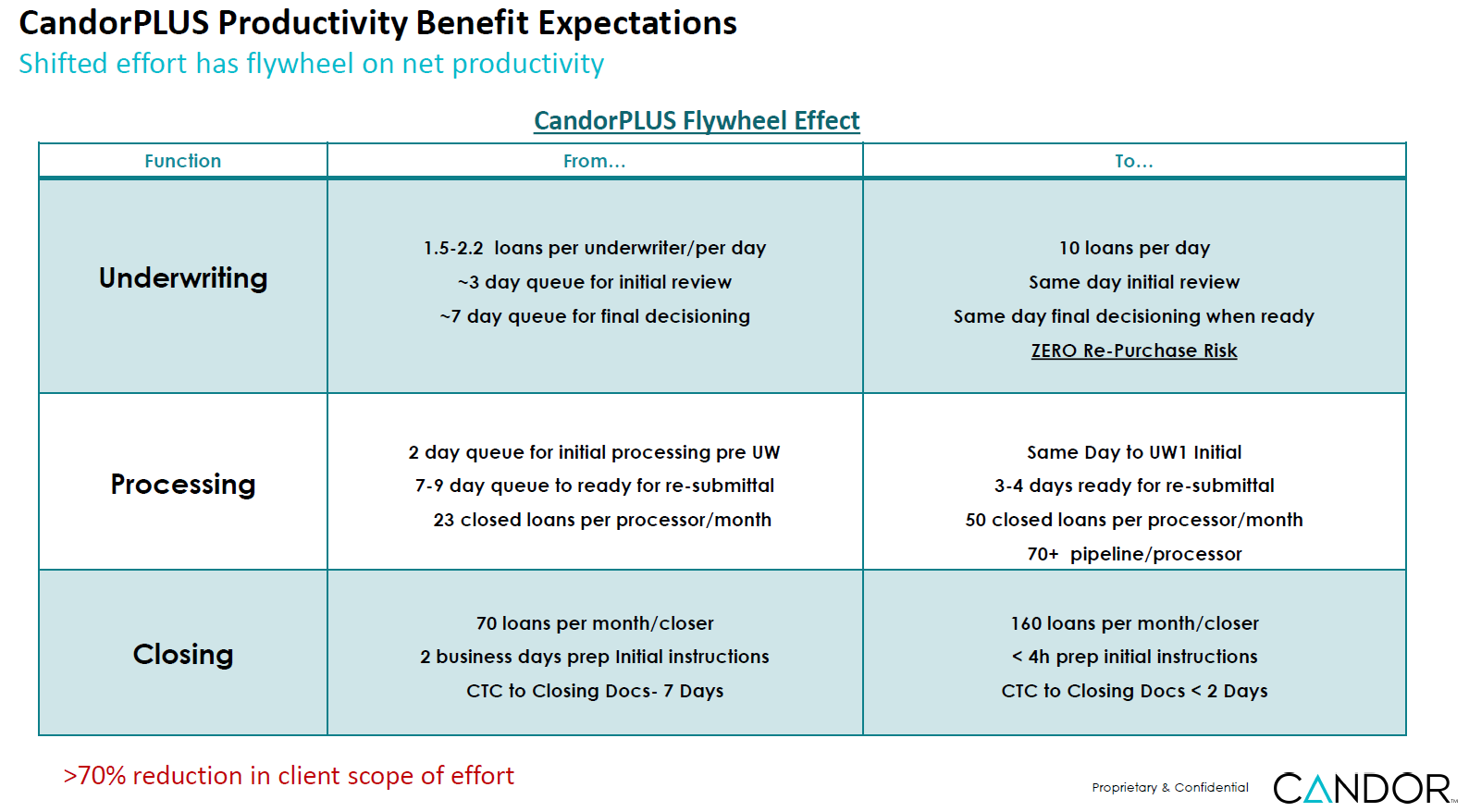

CandorPLUS is the first and only patented technology-driven mortgage loan fulfillment service that spans the entire loan lifecycle from disclosures to closing.

- Decision-ready files with machine precision

- Instantly and infinitely scalable to match volume

- All loan types and lifecycle stages