CASE STUDY

Enhancing Mortgage Processing Efficiency with CANDOR

Background

In the competitive landscape of mortgage lending, speed and accuracy in loan processing are paramount. Candor, a pioneer in AI-driven underwriting technology, is committed to revolutionizing the mortgage industry by significantly enhancing the processing efficiency of mortgage companies.

Objectives

To demonstrate the effectiveness of Candor’s AI technology, a comprehensive study was conducted comparing Candor-processed loans with non-Candor-processed loans across various channels including retail, joint ventures, and third-party originations (TPO).

Methodology

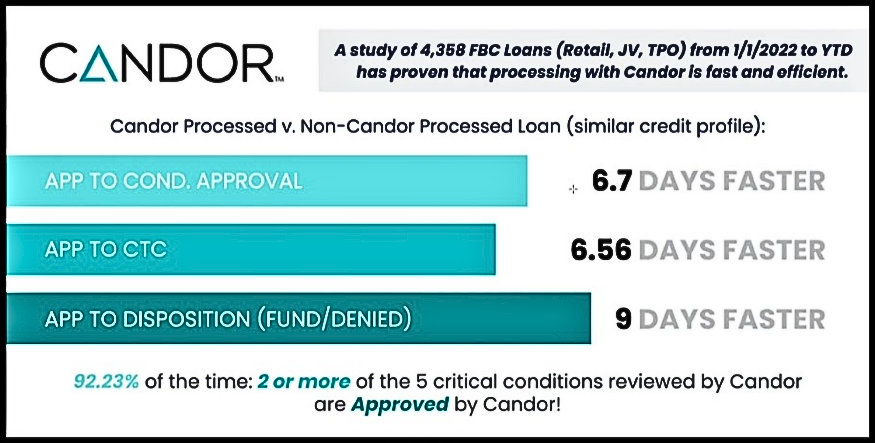

The study analyzed a total of 4,358 loans processed year-to-date (2024) using Candor’s technology. These loans were compared against a control group of similar credit profile loans processed without Candor’s technology.

Results

The comparison yielded compelling results favoring Candor’s technology:

Application to Conditional Approval: Loans processed with Candor reached conditional approval 6.7 days faster than those processed without.

Application to Clear to Close: The timeframe from application to clear to close was 6.56 days shorter for Candor-processed loans.

Application to Final Disposition: Candor-processed loans reached final disposition 9 days faster than non-Candor processed loans.

Additionally, in 92.23% of cases, at least two or more of the five critical conditions reviewed by Candor were approved directly through the AI technology, underscoring the accuracy and reliability of the system.

Conclusion

The data from this study clearly demonstrates that Candor’s AI underwriting technology not only speeds up the mortgage processing timeline but also ensures a high degree of accuracy and compliance. By integrating Candor’s solution, mortgage lenders can achieve faster processing times, enhance customer satisfaction, and maintain a competitive edge in the market.