AI-Powered Underwriting Built for Today's Modern Mortgage Industry

Better Data. Smarter Decisions. Superior Outcomes.

The Only Patented decision engine in the industRy

What Is CANDOR Technology?

CANDOR emulates how an Underwriter thinks.

CANDOR analyzes loan data and borrower docs against investor guidelines.

CANDOR creates and clears conditions BEFORE the Underwriter touches the file.

CANDOR identifies exceptions for the Underwriter to address and surfaces them as conditions in the LOS.

CANDOR scores loans consistently 100% of the time, ensuring loans with similar circumstances are solved the correct way, helping eliminate bias.

CANDOR captures data that supports repurchase defense.

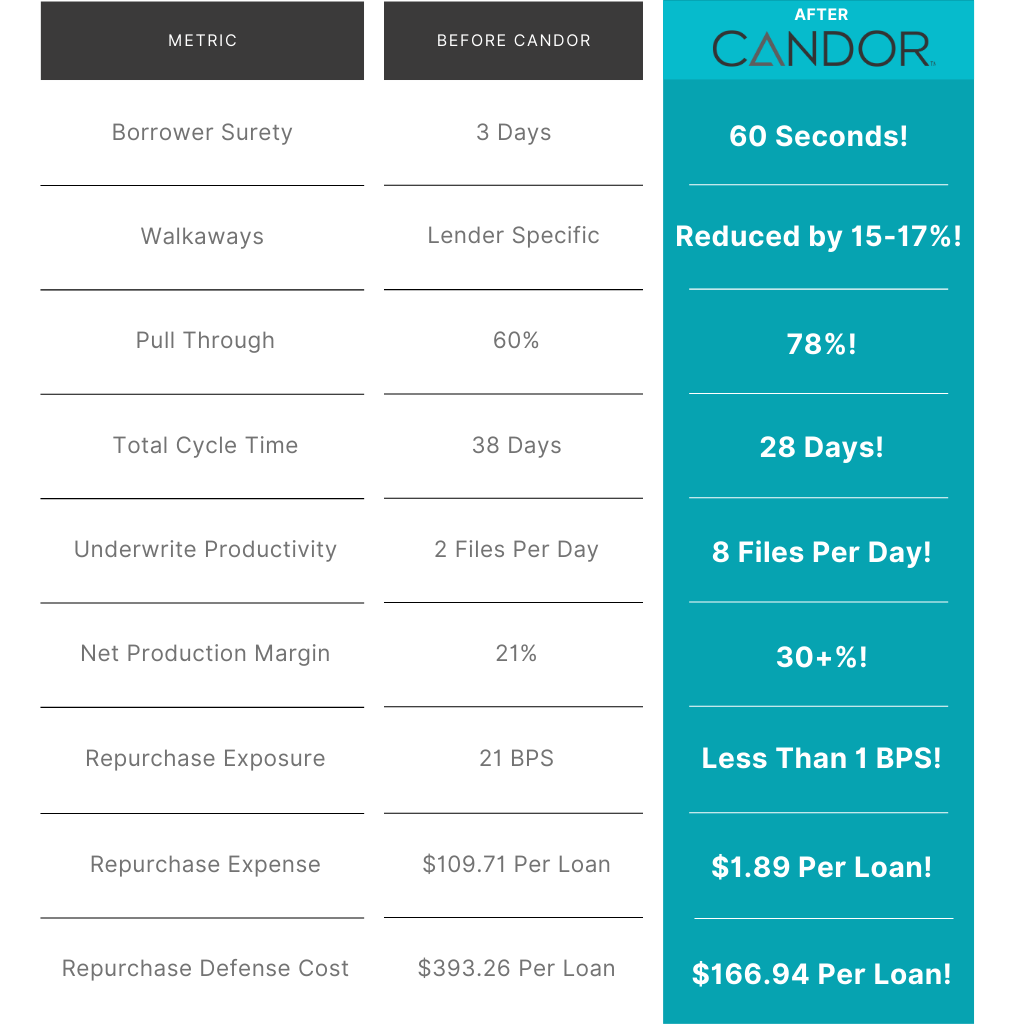

Cost reducer+

Economic Impact

Candor is not just a cost reduction for originators, it gives the flexibility to remake the business model for the 21st century.

"Candor is our secret to success in this market cycle. We've cut our cycle time in half, and I don't have to worry about the integrity of the underwrite so we're not sacrificing quality for speed."

Kenny Parkhurst

Chief Operating Officer

GET A RATE MORTGAGE

Featured Testimonial

Our loans that are run through Candor are higher quality with reduced errors, which has resulted in the loans being purchased faster by the investors thus saving us money on the back end.

Laurie Duda

Vice President

DSA/USA

More User Testimonials

See what our clients have to say about how Candor has transformed their mortgage processes with AI technology.

Featured Resources

Check Out Our Latest Resources